When we talk about economic trends affecting markets, we’re essentially looking at the major forces that shape how businesses, investors, and consumers make decisions. These trends can influence stock prices, consumer confidence, interest rates, global trade, and even personal financial planning. Understanding these trends is not just for economists or investors—it’s for anyone who wants to make informed financial choices, protect their assets, or anticipate changes in the market.

In today’s fast-paced global economy, staying aware of these trends can help you respond to market shifts, avoid unnecessary risks, and even capitalize on opportunities. Let’s take a closer look at the key economic trends currently shaping markets.

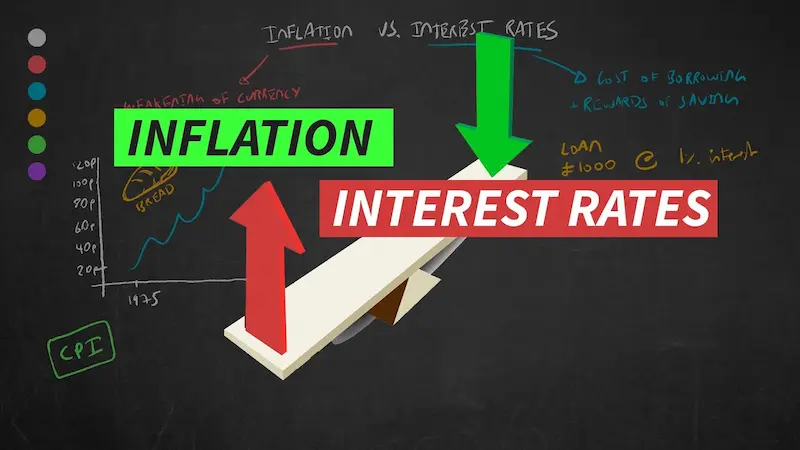

1. Inflation and Interest Rates

Inflation is one of the most immediate economic trends affecting markets. When prices rise too quickly, the purchasing power of money declines, meaning that goods and services cost more. Central banks, like the Federal Reserve in the U.S., often respond by raising interest rates.

Higher interest rates can have several effects:

- Borrowing becomes more expensive: Individuals and businesses may delay loans for homes, cars, or expansion projects.

- Investment slows down: Companies may postpone new projects or hiring, impacting growth.

- Market volatility increases: Stock and bond markets often react to interest rate changes.

On the flip side, lower interest rates can stimulate economic activity by making borrowing cheaper and encouraging spending and investment. Investors often monitor inflation and interest rate trends to anticipate market movements and adjust portfolios accordingly.

2. Technological Advancements

Technology is a game-changer for global markets. From artificial intelligence and automation to blockchain and green energy solutions, technological advancements are reshaping industries and consumer behaviors.

- Opportunities: New technologies create entirely new markets, such as electric vehicles, cloud computing, or fintech solutions.

- Disruption: Traditional businesses may face challenges if they fail to adapt to innovation. For example, brick-and-mortar retail has been disrupted by e-commerce platforms like Amazon.

- Market impact: Investors often reward companies that embrace technology, leading to rising stock prices for tech-savvy businesses.

Understanding technology trends is crucial because they often dictate which sectors will thrive and which might decline in the coming years.

3. Global Supply Chain Dynamics

Global supply chains are the backbone of international trade, and disruptions in these systems can significantly impact markets. Issues like trade disputes, transportation delays, labor shortages, or geopolitical tensions can cause:

- Product shortages: Leading to higher prices and reduced availability for consumers.

- Business slowdowns: Companies may struggle to meet demand if key materials are delayed.

- Market reactions: Stock prices in affected industries may drop, while competitors or alternative suppliers benefit.

Recent examples, like shipping bottlenecks during the COVID-19 pandemic, demonstrate how supply chain dynamics can ripple through markets worldwide.

4. Consumer Spending Patterns

Consumer confidence is a major driver of economic growth. When people feel secure about their finances, they spend more. Conversely, fear of economic downturns can lead to reduced spending.

- Shifts in behavior: Trends like e-commerce, eco-friendly products, and digital subscriptions are changing how consumers spend money.

- Market influence: Companies that align with consumer preferences often see stock price growth, while those that lag may struggle.

- Sector impact: Retail, travel, and entertainment industries are particularly sensitive to changes in consumer spending patterns.

Keeping an eye on consumer behavior trends helps businesses and investors predict which sectors will perform well.

You may also like to read this:

Global Affairs Political Changes: Key Insights & Trends

Global Affairs World Relations: Key Insights For Today

Global Affairs International Reports | 2025 World Guide

Economic Trends 2026 Forecast: Global Outlook Guide

Latest Economic Trends Update 2025: Global Insights

5. Government Policies and Regulations

Government decisions play a critical role in shaping markets. Fiscal policies, taxation changes, and regulations can either stimulate growth or create challenges for businesses.

- Stimulus measures: Government spending packages can boost economic activity and market confidence.

- Regulatory changes: Stricter rules may increase costs for industries like finance, energy, or healthcare.

- Taxation adjustments: Changes in corporate taxes can impact company profits and stock valuations.

Investors often follow government announcements closely because they can have immediate and long-term effects on market performance.

6. Global Economic Shifts

No market exists in isolation. Global events—from recessions and trade agreements to currency fluctuations and emerging market growth—affect investment decisions worldwide.

- Emerging markets: Rapid growth in countries like India or Brazil can attract foreign investment.

- Global recessions: Economic slowdowns in major economies can trigger market volatility globally.

- Commodity prices: Shifts in oil, metals, or agricultural products influence markets across multiple sectors.

Understanding global trends allows investors to diversify portfolios and hedge against risks in volatile regions.

7. Environmental and Social Factors

Sustainability and social responsibility are increasingly influencing markets. Companies that focus on ESG (Environmental, Social, Governance) principles tend to attract more investors.

- Environmental impact: Businesses investing in green technology often see long-term growth.

- Social responsibility: Companies that treat employees fairly and engage with communities build consumer trust.

- Governance: Strong leadership and ethical practices reduce risks for investors.

Ignoring these factors can lead to reputational damage and lower investor confidence, which in turn affects market performance.

How Investors Can Respond to These Trends

Understanding economic trends affecting markets is only part of the picture. Here’s how investors and individuals can respond:

- Stay informed: Follow economic reports, market news, and global developments.

- Diversify investments: Spread risk across sectors, industries, and regions.

- Focus on long-term trends: While markets fluctuate daily, long-term trends offer clearer insights.

- Seek professional advice: Financial advisors and market analysts can help interpret complex trends.

- Adapt to innovation: Embrace technological and sustainability trends to capitalize on emerging opportunities.

Conclusion

In summary, economic trends affecting markets are multifaceted and constantly evolving. From inflation and interest rates to technological innovation, global supply chains, consumer behavior, and ESG factors, each trend has a tangible impact on market performance.

By understanding these trends, investors, businesses, and individuals can make smarter decisions, mitigate risks, and seize opportunities in a rapidly changing global economy.

FAQs: Economic Trends Affecting Markets

1. What are economic trends affecting markets?

Economic trends affecting markets are patterns or shifts in the economy that influence how businesses, investors, and consumers make decisions. These include factors like inflation, interest rates, technological changes, and global trade developments.

2. How does inflation impact markets?

Inflation reduces the purchasing power of money, often prompting central banks to raise interest rates. This can slow borrowing, affect consumer spending, and cause fluctuations in stock and bond markets.

3. Why are interest rates important for investors?

Interest rates directly affect borrowing costs and investment returns. Higher rates may slow economic growth, while lower rates encourage spending and investment, impacting stock, bond, and real estate markets.

4. How do technological advancements influence market trends?

Technology creates new business opportunities, increases efficiency, and can disrupt traditional industries. Companies that adapt to technological trends often experience growth, which attracts investors and affects stock prices.

5. What role do global supply chains play in market performance?

Disruptions in global supply chains—like trade disputes, transportation issues, or geopolitical tensions—can lead to product shortages, increased costs, and volatility in affected markets.